Commercial Real Estate Appraisal: A 10 Point Guide to CRE Valuation

This 10 point guide to CRE appraisals will help you understand commercial appraisal methods and how commercial appraisers establish the scope of work required for a specific assignment.

With this CRE knowledge and insight, you will understand the commercial appraisal methods, the appropriate scope for your circumstances as well as how to help make the process more efficient by knowing what data the appraiser needs to complete the appraisal.

You will learn:

- Why You May Need a Commercial Property Appraisal

- The Commercial Appraiser’s Role and Responsibilities

- Commercial Appraisal Scope of Work

- The Appraisal Inspection and Helpful Data

- Highest and Best Use: As Vacant & As Improved

- Commercial Appraisal Methods: Three Approaches to Value

- The Sales Comparison Method

- The Income Capitalization Method

- The Cost Method

- Commercial Appraisal Final Reconciliation

Why You May Need a Commercial Property Appraisal

A commercial property appraisal may be critical to important decisions that carry risk factors, like a mortgage with a high loan to value ratio, or it may be a low-risk matter of routine due diligence required for compliance by private or governmental organizations.

Most commercial appraisals are ordered for banking-related activities, but there are many more use cases where commercial property appraisal is central to important asset management decisions.

While market participants may have a good handle on a given property’s value, a commercial appraisal codifies and certifies the property value in an unbiased legal document by a licensed appraiser.

Banking Related Commercial Appraisal Activities

- Mortgage financing for purchase

- Mortgage refinancing

- Distress property negotiation

- Foreclosure/workouts

CRE Asset Management Activities Include

- CRE tax appeal

- Purchase due diligence

- Partnership value allocations

- CRE buy, sell, financing decisions

Governmental Activities that Require Commercial Real Estate Appraisals

- CRE tax assessment valuation

- Property acquisition or disposition

- Contract and market lease analysis and negotiation

- Eminent domain proceedings

Commercial Real Estate Appraisals for Litigation Purposes

- Estimating damages from loss of utility and value as a result of encroachments, impairment of ingress/egress, the presence of hazardous waste, lost income from broken leases, etc.

- Resolving equity disputes.

- Estimating value loss from construction defects.

- Tax appeals

- Insurance disputes

The Commercial Appraiser’s Role and Responsibilities

Define the Appraisal Problem

The first order of business for an appraiser is to establish the appraisal problem to be solved. Think of this as understanding the context of the appraisal: Why is the appraisal being ordered? Who is ordering the appraisal? How will it be used? Who will read and make decisions based on the appraisal?

Answering these questions guides the appraiser in determining his or her competence for the appraisal problem, the level of research and analyses required, and how much detail to include in the report.

Defining the problem is key for the appraiser to provide a quote for appraisal services.

Appraisers Cannot Produce an Inadequate or Misleading Appraisal

The appraiser has a duty to provide services that are not inadequate for the appraisal problem or produce a misleading report. For example, a client requests a ‘drive-by’ appraisal on a complex income property with incomplete financial information. In most cases this can only be done with prominent and clear disclosures and assumptions informing the client of the limitations of the appraisal and associated risks. Unless there are extenuating circumstances, most appraisers would decline such an assignment.

CRE Appraiser Competency

The appraiser must provide a level of competency, research, due diligence and analysis that is adequate for the scope of the appraisal.

CRE Property Types

The Appraisal Institute Commercial Appraisal Data Standards (AICDS) lists 13 major property types and literally hundreds of sub-types.

- Agricultural

- Assembly/Meeting Place

- Health Care

- Industrial

- Land

- Lodging & Hospitality

- Multi-Family

- Office

- Retail-Commercial

- Senior Housing

- Shopping Center

- Special Purpose

- Sports & Entertainment

Most commercial appraisers develop and maintain a competency around common property types within their market area. Competency includes market area knowledge and competency for a given property type in one market does not guarantee competency in a different market area. That said, a commercial appraisal skill set is transferable and data is generally available such that a professional appraiser can work across different markets.

Appraiser competency is far reaching and truly requires key knowledge of the property type and market area.

For an income property appraisal, for example, the appraiser is required to thoroughly understand the subject and competitive market rental rates for all of the space types within the subject property, as well as market vacancy rates, each individual expense, overall expense ratios, and capitalization rates. But it doesn’t end there, the appraiser should understand the typical buyer profile and motivation, as well as typical marketing times for the market area.

In short, the appraiser must know how to handle the appraisal problem and know the market.

The Appraiser Has a Fiduciary Relationship with the Client

When a commercial appraiser is engaged for an assignment, s/he has a fiduciary relationship with the client and a responsibility for maintaining confidentiality. This means subject property information disclosed during the appraisal that is not publicly available is considered confidential. The appraiser may only disclose the appraisal findings and report with the client or as directed by the client.

Client Responsibilities

The client may only use the appraisal for the intended purpose stated in the appraisal. For example, if a client requested an appraisal for mortgage financing, and then used the appraisal as documentation for a property tax appeal, the appraiser would have no responsibility or liability for this unauthorized use.

The Appraisal Work File

Appraisers are required to create a work file for every assignment. The work file contains all the data used in the appraisal process and must be retained for a period of five years, depending on state licensing requirements. Other conditions such as litigation can extend the data retention requirement. Work files are discoverable in legal matters.

Establishing the Commercial Appraisal Scope of Work

The appraisal scope sets the framework for the level of research and appraisal valuation methods required. Sometimes the scope of work can be quite limited and require only one valuation method with a short report summarizing the assignment parameters, the subject property, valuation analysis, and conclusion. This report might be as short as ~50 pages (you read that right, most commercial appraisal reports are longer). This type of short report is suitable for clients that know the market, subject property type, and risk is low.

Other times the scope of work is exhaustive requiring a high level of research, application of all relevant valuation methodologies, a well reasoned and detailed rationale for the value conclusion, and a lengthy, detailed, and technical appraisal report. This type of report can be thought of as a stand-alone appraisal, containing all the information necessary for a reader to fully understand the market, subject property, valuation analyses, and final conclusion.

Some examples that require varying levels of scope:

| Property Complexity | Purpose | Client | Scope of Work |

| Non complex. For example, a condominium office unit. | Mortgage underwriting for a 50% LTV loan. | Local lender that knows the market, neighborhood and has the subject property in it’s portfolio. | Minimal: A summary market analysis, summary property description and one approach to value. |

| Moderately complex. For example a multi-tenant office building. | Mortgage underwriting for a 80% LTV loan. | Local lender that knows the market, but not the neighborhood or property. | Moderate: A complete market analysis, property description and all applicable valuation methods. |

| Complex. For example a multi-tenant office building that will lose critical parking spaces through eminent domain for a new highway project. | Valuation of damages caused by loss of parking. May include litigation. | Property owner and representatives. Stated use of appraisal includes litigation support. | Maximum: Complete, detailed market analyses, property description and all applicable valuation methods. |

Scope of work for a commercial appraisal typically describes:

- The date and extent of the property inspection, including legal description and tax record identification.

- Market area analyses and data sources consulted.

- Zoning analysis, including conformity and right to rebuild.

- Highest and Best Use analysis.

- Valuation methods applied and data sources, including interviews with city officials and market participants.

- Other data sources utilized, including internal office files, analyses, and data.

The Appraisal Inspection and Helpful Data

The appraiser’s inspection is very different from a professional Property Condition Assessment (PCA) inspection where building systems are tested and all or most of the property is thoroughly inspected.

The appraiser’s inspection is less intensive. For example, only representative areas are inspected and the balance of the uninspected areas are assumed to be commensurate with the areas viewed.

Plumbing, electrical and other building systems are not tested by the appraiser, rather they are quantified and rated for the purpose of valuation analysis.

Property Data Helpful for the Appraisal Process

When available, these data include:

- Site plans

- Floor plans

- Year built and renovations made over time.

- Planned capital improvements.

- For income properties, historic income and expense data – ideally three years of historic data.

- For income properties, recent leases, current budget and year to date income and expenses.

- Any information that might affect the valuation of a property, such as hazardous waste, high delinquencies, major tenants that have announced they will not renew, or conversely, major tenants that are likely to sign a new lease as examples.

- Information related to recent local market activity. Property owners and managers often have their ear to ground and have knowledge of market activity before the general public.

Highest and Best Use

Commercial markets and highest and best use can be very dynamic. For example, an apartment complex might have a higher worth as a condominium complex. Residential properties close to business centers are often repurposed as offices, retail, restaurants, and more recently to AirBnB. The demise of the mall and the rise of Airbnb are contemporary examples of real estate market dynamics.

Estimating Commercial Real Estate Highest and Best Use

How does an appraiser determine the highest best use for commercial property? By answering the four tests of highest and best use:

- Legally permissible: What does zoning or other land use controls allow? This will form a broad set of use possibilities for the subject.

- Physically possible: What is the property physically capable of supporting? This criteria often narrows the group of use possibilities.

- Financially feasible: Which legally permissible and physically possible use will produce a return? Financial analysis is now considered for each of the contending uses for the subject, eliminating uses that are not economically viable.

- Maximally productive: Of the feasible uses identified, which will produce the best return? Note that when maximally productive uses are considered, weight should be given to the most probable use. Moonshot high-value uses rarely qualify as highest and best use.

Highest and Best Use Scenarios: As Vacant & As Improved

CRE highest and best use analysis is often applied under two scenarios:

- Highest and best use as vacant

- Highest and best use as improved

The two analyses may yield different results, often when the existing improvements are old or obsolete and it makes more sense to redevelop the site.

Commercial Appraisal Methods: Sales, Income and Cost

Appraisal methods are often called referenced as approaches to value. There are generally three CRE valuation methods/approaches:

- The Sales Comparison Approach

- The Income Approach

1. Direct Capitalization

2. Discounted Cash Flow Analysis

3. Gross Income Multipliers - The Cost Approach

Development Method

Additionally there is the Development Method, which incorporates a combination of cost, sales and income methodologies. This is typically used for residential development, but also used for many non-residential developments where units are sold over time.

Statistical Analysis

Other methods include statistical analysis, which today includes machine learning and other advanced technologies to evaluate a large population of properties. Real estate tax assessments are typically generated by statistical methods. These methods provide reliable values most of the time, but there is always a percentage of properties that don’t fit the model and have incorrect values.

The Sales Comparison Method

Also called the Sales Comparison Approach, Market Approach or Sales Analysis.

The sales comparison method is based on market activity for similar properties in the subject’s competitive market area. The subject is compared with sales, contracts and listings of similar properties. Differences between the subject and comparables are identified and analyzed, resulting in an indication of value for the subject.

Sales Comparison Grid

Sales analysis is typically done using a sales comparison grid, where side-by-side comparisons can be viewed and a range of value is indicated for the subject property. With a range of values established, each comparable is analyzed for fit with the subject. The comparables that require the fewest adjustments are usually the most reliable indicators of value which ideally would bracket the subject’s value with a narrow range. The final step is to reconcile to a final value estimate.

Sales Comparison Unit Values

Think of unit values as common denominators among a group of properties. These are valuation benchmarks that can readily be compared among properties.

Common CRE Unit Values

- Price per square foot

- Price per unit

- Price per seat

- Price per bed

- Price per room

Sales comparison valuation methodology is a sound approach to value when there is an adequate number of comparables. The latter is less of an issue today with the advent of data companies constantly scouring the market for new transactions.

Things to consider when reviewing a CRE sales analysis:

- Similar comps are key. An emphasis should be placed on the selection of similar comparable sales; similar comparables will require the fewest adjustments and therefore more similar and reliable.

- Recent similar comps are the best comps. Older sales should be avoided as markets change over time, sometimes with general economic trends, sometimes with events, like the Coronavirus.

- Large adjustments, individual or cumulative are risky. More often than not, appraisers make sound, well reasoned adjustments. However, quantitative support is often lacking and the cumulative effect of several adjustments can compound and produce an erroneous value indication.

Gross adjustments (both positive and negative adjustments) should not be excessive, say 25% to 35% – many appraisers would suggest an even lower range. Every market and property is different and in commercial property valuation, sometimes large adjustments are unavoidable. If large adjustments are required, the appraiser should provide logic and rationale for the adjustments.

- Listings have their place. Including current listings as comps adds additional insight to the analysis, and these should set the high end of the range. If the subject has been valued above competitive listings, this should alert the appraiser to review the analysis.

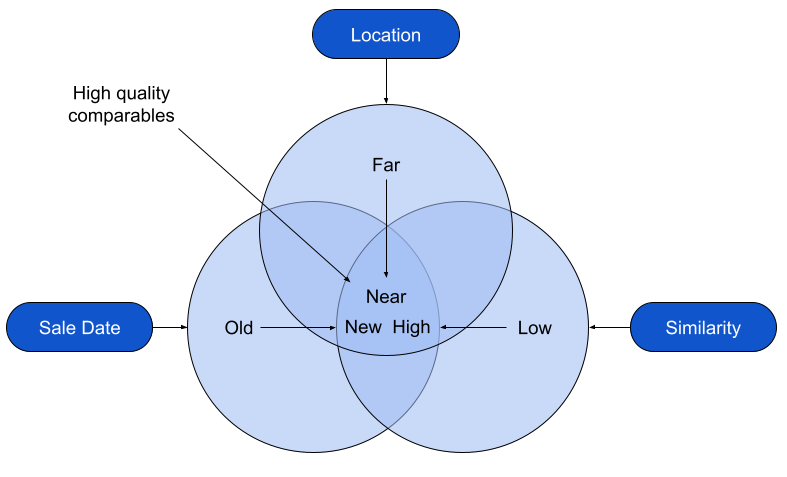

This venn diagram shows the target spot of CRE comparable property selection.

The Income Capitalization Method

The Income Capitalization method converts net income to value through a capitalization or discounting process. For income producing commercial real estate, this method is frequently used and relied on in the marketplace.

Steps to CRE Direct Capitalization:

| Step | Component | Example |

| 1 | Potential Gross Income (PGI) | $1.00 |

| 2 | – Vacancy and Collection Loss | 5% |

| 3 | = Effective Gross Income (EGI) | $0.95 |

| 4 | – Expenses | -$0.40 |

| 5 | = Net Operating Income | $0.55 |

| 6 | / Capitalization Rate | 7.0% |

| 7 | = Value | $7.86 |

The income approach is arguably the most complicated CRE valuation method. Each step in the analysis builds on the previous step, so diligence is key to avoiding the cumulative effect of small errors.

Understanding the Cumulative Effect of Small Errors

As an example, a slightly high estimate of PGI, a slightly low estimate of vacancy and collection losses, followed by a slightly low estimate of expenses will produce an inflated NOI. Applying a slightly low capitalization rate will likely produce an inflated value. Yet the small individual errors that compounded to produce this result might not be apparent to the untrained eye.

Fortunately, commercial appraisers have several tools available to verify each step of the analysis.

What is Stabilized Income?

Stabilized income is what the subject should generate to be consistent with the market. Stabilized income is usually synonymous with stabilized occupancy at market rents. For example, if most properties in the competitive market area are running at 90 to 95% occupancy, we would expect the subject to be in this range.

When using the income capitalization method, stabilized income is used for the subject cash flow projection. This provides a value estimate for the subject “as stabilized” – a prospective future value. To get the current “as is” value an adjustment for lease-up expense is deducted from the “as stabilized”value.

Adjustment for Stabilization Lease-up

Stabilization expenses include marketing and leasing commissions, potentially some level of fit up for new tenants, lost income, and additional expenses incurred from carrying extra vacant space.

Stepping Thorugh the Income Approach

Elements to consider when preparing or reviewing an income capitalization analysis.

- PGI: What are the current lease contracts? Is the property subject to a long-term lease that is out of step from the market? What is the lease expiration schedule? How much space could potentially turnover over the next one to five years? Are there recent leases at the subject? If so, how do they compare with the market? Is the property vacancy rate higher than the market? Will there be a lease-up period necessary to bring the property up to stabilized income?

If the analysis assumes a lease-up phase is required before the property archives stabilized occupancy, there should be an adjustment for this expense.

The overarching goal is to understand the likely cash flow the subject will produce, and the risk level of the cash flow.

- Vacancy and collection loss: What are the vacancy collection rates at the subject and how do they compare with the market?

- Effective Gross Income: If PGI and vacancy and collection loss are properly developed and applied the resulting EGI will be reliable. The appraiser’s estimate of EGI should be similar to historic performance in caes where the property is operating at stabilized occupancy.

- Expenses: Each line-item expense and the overall expense ratio are reviewed and compared with other similar properties as well as published expense data.

If there are significant variances between a projected expense and the subject’s history or comparables, this should be explained and adjusted as necessary. For example if last year’s heat expense was $2.00 per square foot and this year it is projected to be $1.50 per square foot (due to weather-proofing the building with new windows and insulation, for example), this should be explained.

The overall expense ratio is a key metric when comparing the actual and projected expenses for the subject. The expense ratio reflects the relationship of EGI to Expenses:

Expenses / EGI = Expense Ratio

Note that expenses do not include depreciation or debt payments. These are investment expenses, not real estate expenses.

- NOI: If EGI and Expenses have been properly developed and applied the resulting NOI will be reliable.

- Capitalization Rate: Also known as “cap rate” or “overall cap rate” (Ro), the cap rate defines the relationship between price/value and NOI. Inherent in this rate is risk and expected returns.

Lower cap rates signify confidence in a property’s ability to generate returns, while higher cap rates reflect higher risk.

Capitalization rates have significant leverage in the valuation process and should be well researched and clearly supported with market data including comparables, published surveys and “built-up” cap rates using formulas incorporating lender and investor requirements.

Here is the formula for converting NOI to value:

NOI / Capitalization Rate = Value

Published Surveys

There are numerous resources that track and publish capitalization rates for national and regional markets by property type. These rates are useful for bracketing the subject’s likely cap rate range as the local market area may have different cap rate drivers. Over time these surveys will become more and more granular and useful.

Formulas for Building a Capitalization Rate

There are a number of formulas that blend typical lender and investor requirements. Two of the most common are the Band of Investment and Debt Coverage Ratio methods.

Band of Investment Formula

| Band of Investment | ||||

| Mortgage Constant (Rm) | x | LTV (Loan to Value) | = | Weighed Lender Requirement |

| Equity Dividend Rate | x | Equity | = | Weighted Investor requirement |

| = | Capitalization Rate |

Debt Coverage Ratio Formula

| Debt Coverage Ratio Method | ||||||

| Debt Coverage Ratio | x | LTV | x | Mortgage Constant | = | Capitalization Rate |

Market Extracted Capitalization Rates

When NOI for a comparable property is known, market extracted cap rates can be calculated with this formula:

NOI / Price = Capitalization Rate

Critical to this formula is the development of NOI. Often, published comparable data includes NOI but not a breakdown of expenses used to determine NOI. Line item expenses will often vary from property to property and market to market and may include or exclude certain expenses items. When that happens, we are comparing apples to oranges.

This where a thorough analysis of expense ratios will reveal inconsistencies in the comparable data and prompt further investigation.

7. Capitalization to Value

The final step in the income approach to value is to apply the capitalization rate to the subject’s NOI.

NOI / Capitalization Rate = Value

Given the complexities and research required in the income analysis, the final step is remarkably simple!

Discounted Cash Flow Analysis (DCF)

DCF analysis is a more powerful version of the direct capitalization method. The process involves projecting the subject’s cash flow into the future, and proceeds from a future sale of the property, known as the reversion value. DCF cash flows are projected for the entire investment holding period, usually 5 to 10 years.

Annual future cash flows are converted to present value with a discount rate that reflects the investor’s required overall yield (Ye), commonly known as the Internal Rate of Return (IRR).

In cases where there is no debt financing, the discount rate is the investor yield rate or IRR.

DCF Example

| Time Frame | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Cash Flow Source | NOI | NOI | NOI | NOI | NOI & Reversion |

| Cash Flow Amount | $50,000 | $51,500 | $53,045 | $54,636 | $56,275 & $835,000 |

| Discount Rate @ 8% | 0.926 | 0.857 | 0.794 | 0.735 | 0.681 |

| Present Value of Cash Flow | $46,296 | $44,153 | $42,109 | $40,159 | $606,587 |

| Value Indication | $779,304, $780,000, rounded |

The Power of DCF Analysis

DCF is often the go-to analysis for complex, institutional grade commercial real estate. With the ability to explicitly project cash flows based on the terms of each individual lease future cash flows can be articulated with precision.

DCF is also a great tool for income properties that require a period of time to achieve stabilized cash flow.

The Risk of DCF Analysis

As with Direct Capitalization, the risk of compounding errors is always present, but with DCF the risk is amplified.

Gross Income Multipliers

Gross income multipliers rely on high level financial data and can be easily applied. For some property types and markets, multipliers are well defined and frequently used by market participants.

We will review the most common multipliers used by CRE analysts.

- Potential Gross Income Multiplier (PGIM)

- Effective Gross Income Multiplier (EGIM)

PGIM formula: Price / Potential Gross Income = PGIM

EGIM formula: Price / Effective Gross Income = EGIM

Multiplier Valuation

PGI x PGIM = Value

EGI x EGIM = Value

Valuation multipliers are a handy method for quick analyses and as tests of reasonableness for other valuation methods. Similar to the selection of cap rate comparables, multipliers require highly similar property types and expense ratios.

The Cost Approach Method

Cost Approach Valuation Steps

Cost New

– Depreciation

+ Land Value

= Value

The Cost approach has its place in commercial real estate valuation, but it’s role is limited for a few reasons:

- Cost estimation tools and services are sometimes out of step with local markets.

- Cost is not necessarily value.

- Depreciation can be difficult to measure, particularly when the improvements are old or the building has functional problems, such as a poor layout.

The cost approach should set the upper limit of value before depreciation is applied.

When is the Cost Approach Warranted?

There are valuation problems where the Cost Approach is the only valuation method available, despite its limitations. For example:

- A special use industrial property built around a specific manufacturing process.

- School buildings and campuses.

- The property is new and data for sales and income approaches is not available.

Other use cases for the cost approach:

- As a test of reasonableness for other more reliable analyses.

- When ‘Insurable Value’ is requested. Insurable value is essentially the cost to rebuild the subject and excludes land and improvements that survive a fire or other catastrophic event.

Commercial Appraisal Final Reconciliation

The final reconciliation process takes a hard look at each approach applied. The CRE appraiser considers the quantity and quality of data applied for each valuation method, and how closely the approach reflects buyer behavior in the market; does the valuation method reflect how a typical buyer would value the property?

Sales Analysis Reconciliation

A robust sales analysis includes at least three to five recent, proximate and similar sales that require minimal adjustments to bring them to parity with the subject. Note that adding more sales to the analysis does not necessarily improve the reliability of the analysis if they are poor quality comparables.

Chances are if you have three to five recent, proximate and similar sales, this approach will reflect buyer behavior.

Income Analysis Reconciliation

Where income analyses have many inputs, there are more tests of reasonableness to consider.

- Is there adequate support for the estimate of PGI?

- Is the vacancy and collection loss factor adequately supported?

- Are the individual expenses and overall expense ratio consistent with the market?

- Is the cap rate adequately supported?

- Is the property operating at stabilized occupancy and income? If not, has a lease-up expense been deducted from the value indication?

Cost Approach Reconciliation

The cost approach reconciliation considers:

- Support for the land value

- Support for cost estimates

- Support for depreciation adjustments

Final Reconciliation

Finally, how well does each approach reflect buyer behavior? If a typical buyer places emphasis on income analysis, the appraiser should too. Likewise, if a typical buyer places emphasis on comparable sales, such as with single tenant owner-occupied properties, the sales analysis should be as robust as possible, with secondary emphasis given to additional approaches.

Of course, there are times when there is inadequate data for preferred approach. In cases like this, it may be appropriate to give weight to an otherwise secondary approach/methodologies.

A Note About Averaging

Averaging value indications from different approaches is generally frowned upon in the valuation profession as different approaches rarely deserve equal weight (though it is possible). Typically, the appraiser will more closely align the value conclusion with the approach that is most reliable and best reflects buyer behavior.